Self-Employed Mortgage

Being your own boss shouldn’t make it harder to get a mortgage. At CENTUM Indigo Mortgage Corp., we specialize in helping entrepreneurs and self-employed individuals secure the financing they deserve.

Mortgage Options Designed for Business Owners

Turning Self-Employment Into Mortgage Approval

Many self-employed Canadians face unique challenges when applying for mortgages. Traditional banks often require strict income verification that doesn’t always reflect the true financial health of business owners.

At CENTUM Indigo Mortgage Corp., we look beyond the paperwork. With access to a wide network of lenders—including alternative and private financing—we can secure approvals even if your income is structured differently.

Our tailored self-employed mortgage programs are designed to help entrepreneurs, freelancers, contractors, and business owners achieve their dream of homeownership without unnecessary roadblocks.

With years of experience, we simplify the process, negotiate competitive rates, and ensure your mortgage solution aligns with both your personal and business financial goals.

Why Our Self-Employed Mortgages Work

Smart Solutions for Non-Traditional Income

We work with lenders who accept bank statements, business revenue, or alternative documentation instead of traditional income proof.

Every self-employed client is different, so we design mortgage solutions that match your income structure and long-term goals.

From big banks to private lenders, we find competitive options others may not offer self-employed borrowers.

Helping Entrepreneurs Own Homes with Confidence

Why Choose CENTUM Indigo for Self-Employed Mortgages

We understand that being self-employed often means irregular income, multiple revenue streams, or deductions that reduce taxable income. Traditional banks may see this as a risk, but we see it as part of your entrepreneurial journey.

With years of expertise, we know how to present your financials to lenders in the best light possible, increasing your chances of fast approval.

Our team has successfully helped thousands of self-employed clients across the GTA secure mortgages that fit both their lifestyle and financial capacity.

At CENTUM Indigo Mortgage Corp., our mission is to remove the stress, simplify the process, and help you focus on growing your business while we take care of your mortgage needs.

Get in touch

What can we help you with today?

2400 MEADOWPINE BLVD., UNIT 107, MISSISSAUGA, ON L5N 6S2

Phone : (647) 341-2785 (PRIMARY) Alt : (905) 624-2002

amit_khurana@centum.ca

Talk with a Lending Specialist.

How it Works

The Mortgage Process in 4 Easy Steps

From consultation to closing, our simple 4-step mortgage process makes financing your home easy, transparent, and stress-free.

We begin by understanding your financial goals, reviewing your needs, and providing expert advice to outline your best mortgage options.

Based on your situation, we match you with lenders, compare competitive rates, and present customized mortgage solutions for your approval.

Once you decide, we handle paperwork, negotiate terms, and guide you through the approval process, ensuring a smooth experience.

We finalize everything with the lender, confirm details, and ensure you move into your new home stress-free and financially secure.

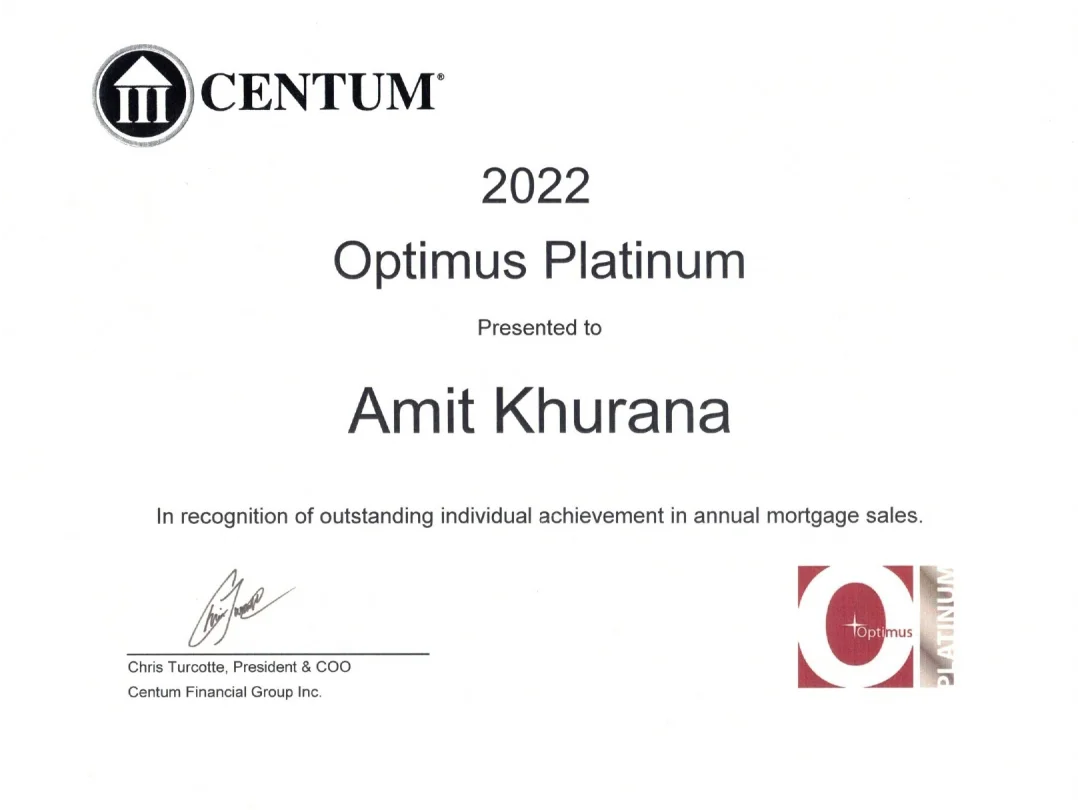

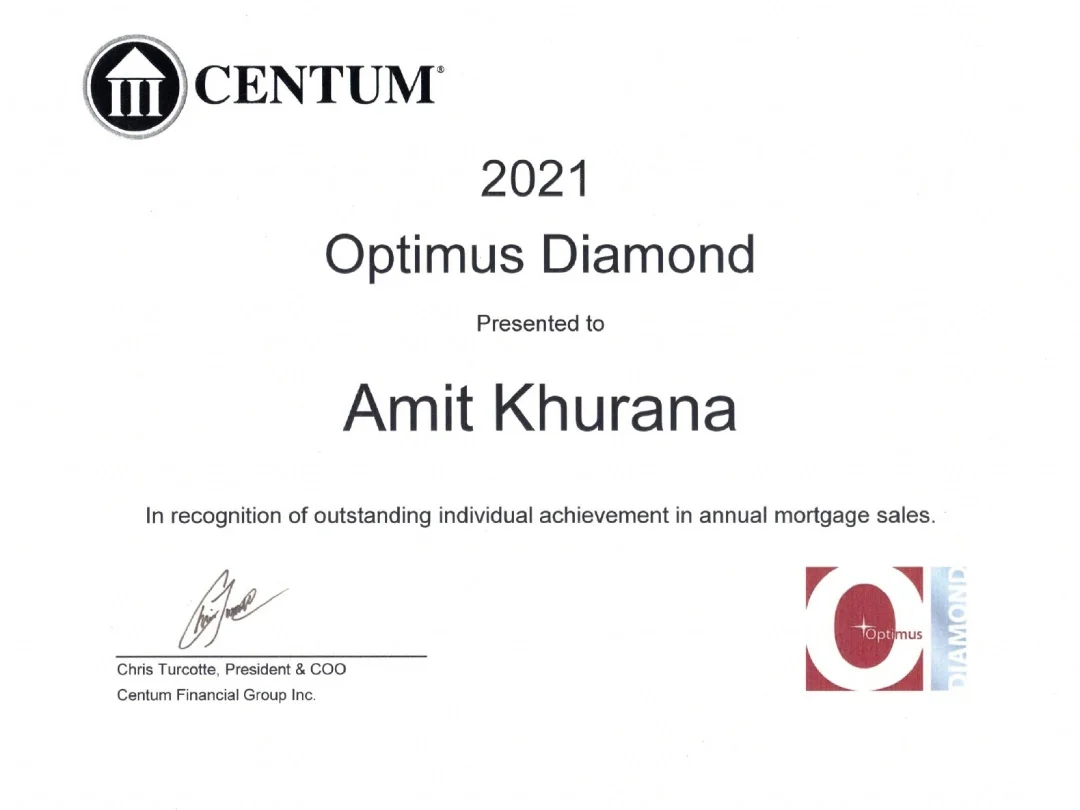

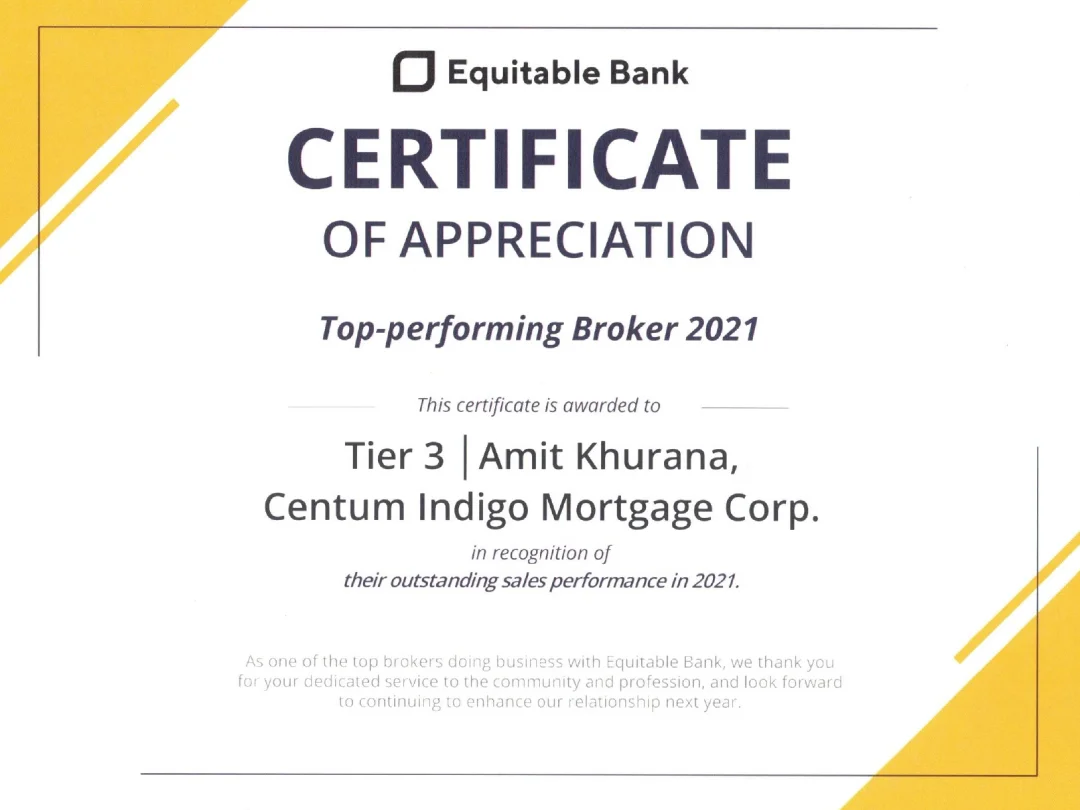

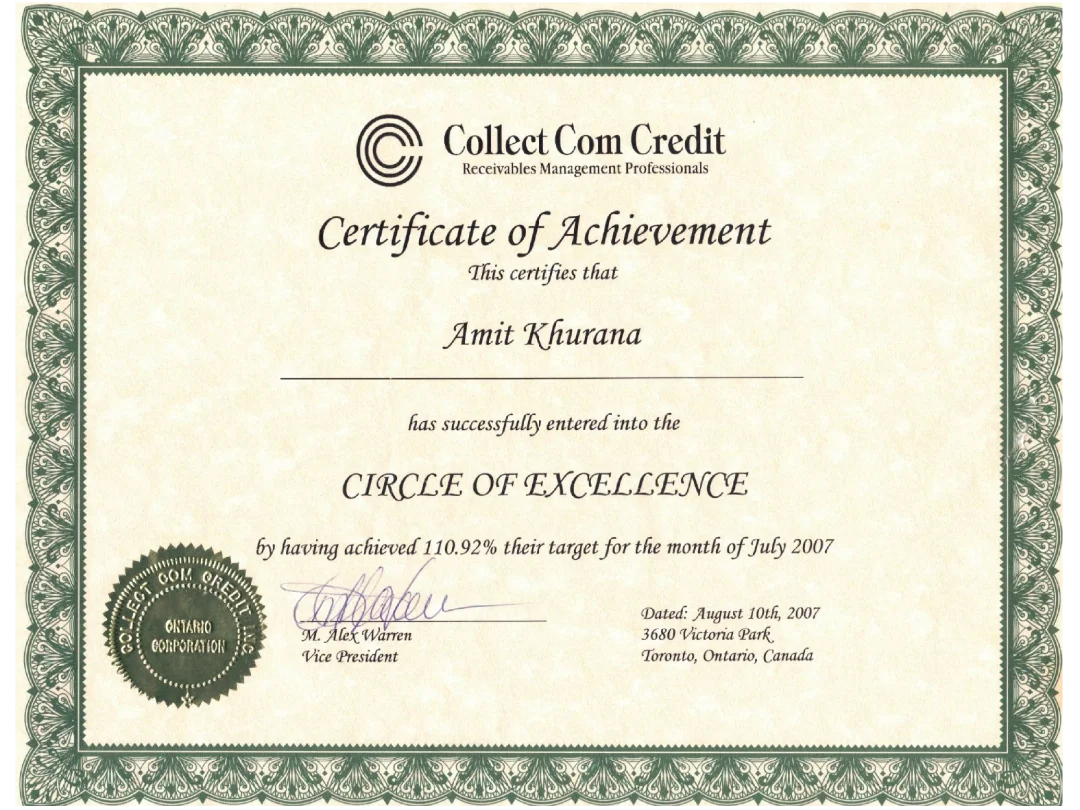

Awards & Accomplishments