Bruised/Bad Credit Mortgage

Don’t let past credit challenges hold you back. We work with alternative and private lenders to help you secure a mortgage—even with bruised or bad credit.

Solutions Beyond Traditional Banks

Helping You Rebuild and Own a Home

Traditional banks often decline mortgage applications from clients with less-than-perfect credit. But at CENTUM Indigo Mortgage Corp., we believe everyone deserves a fair chance at homeownership.

Our network of alternative and private lenders allows us to create customized mortgage solutions designed specifically for clients with bruised or bad credit. Whether you’ve faced bankruptcy, consumer proposals, missed payments, or other financial hurdles—we’re here to help.

We don’t just stop at securing your mortgage. We also guide you on how to rebuild your credit over time, setting you on a stronger financial path for the future.

With our expertise and proven results, we’ve helped countless clients across the GTA achieve homeownership when they thought it was out of reach.

Turning Credit Challenges Into Opportunities

Benefits of a Bad Credit Mortgage Solution

We work with private lenders who offer flexible solutions for clients turned away by traditional banks.

Owning a home and making consistent payments helps you improve your credit score over time.

Every financial situation is unique, and we create a mortgage plan that fits your needs, not just lender rules.

A Path Back to Financial Stability

Why Choose CENTUM Indigo Mortgage Corp. for Bruised Credit Mortgages

We understand that financial setbacks happen—job loss, illness, divorce, or unexpected circumstances can impact anyone’s credit history. What matters most is how you move forward.

At CENTUM Indigo Mortgage Corp., we specialize in turning “no” into “yes.” With strong connections to non-traditional lenders, we can present solutions where others see barriers.

Beyond getting approved, our focus is on helping you rebuild confidence and stability. We provide strategies that improve your credit while ensuring your mortgage remains affordable.

With our trusted guidance, you can secure a mortgage, rebuild your financial profile, and move toward a brighter financial future.

Get in touch

What can we help you with today?

2400 MEADOWPINE BLVD., UNIT 107, MISSISSAUGA, ON L5N 6S2

Phone : (647) 341-2785 (PRIMARY) Alt : (905) 624-2002

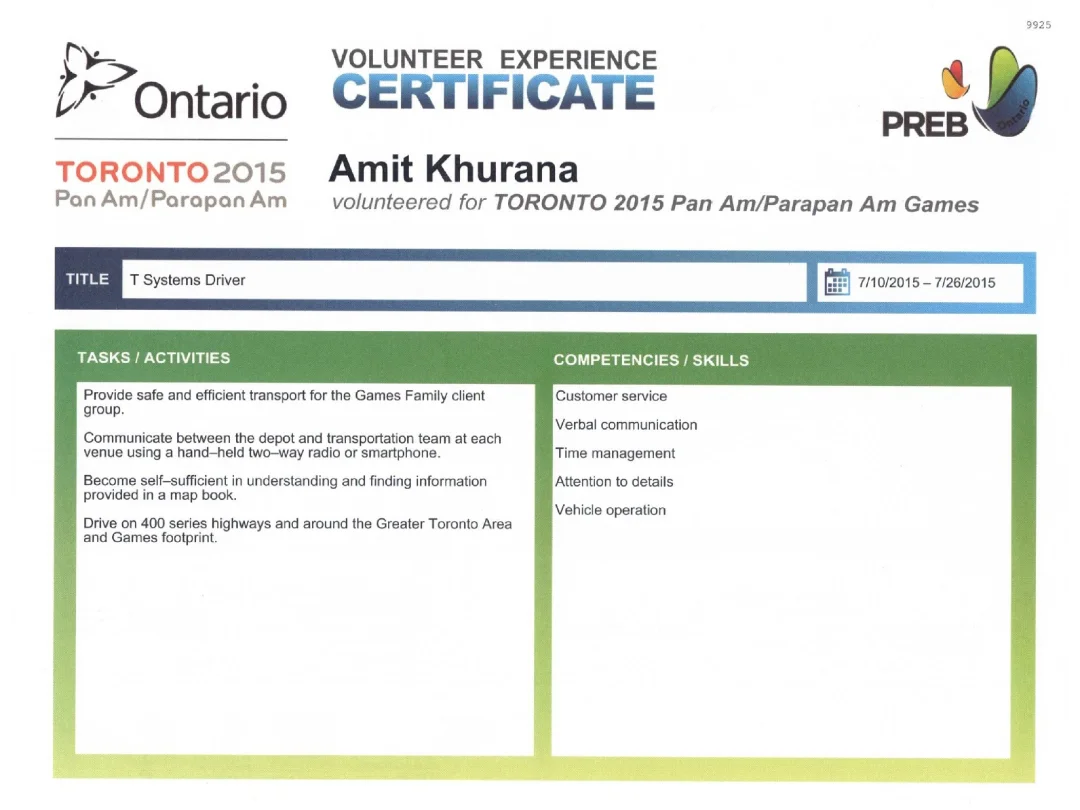

amit_khurana@centum.ca

Talk with a Lending Specialist.

How it Works

The Mortgage Process in 4 Easy Steps

From consultation to closing, our simple 4-step mortgage process makes financing your home easy, transparent, and stress-free.

We begin by understanding your financial goals, reviewing your needs, and providing expert advice to outline your best mortgage options.

Based on your situation, we match you with lenders, compare competitive rates, and present customized mortgage solutions for your approval.

Once you decide, we handle paperwork, negotiate terms, and guide you through the approval process, ensuring a smooth experience.

We finalize everything with the lender, confirm details, and ensure you move into your new home stress-free and financially secure.

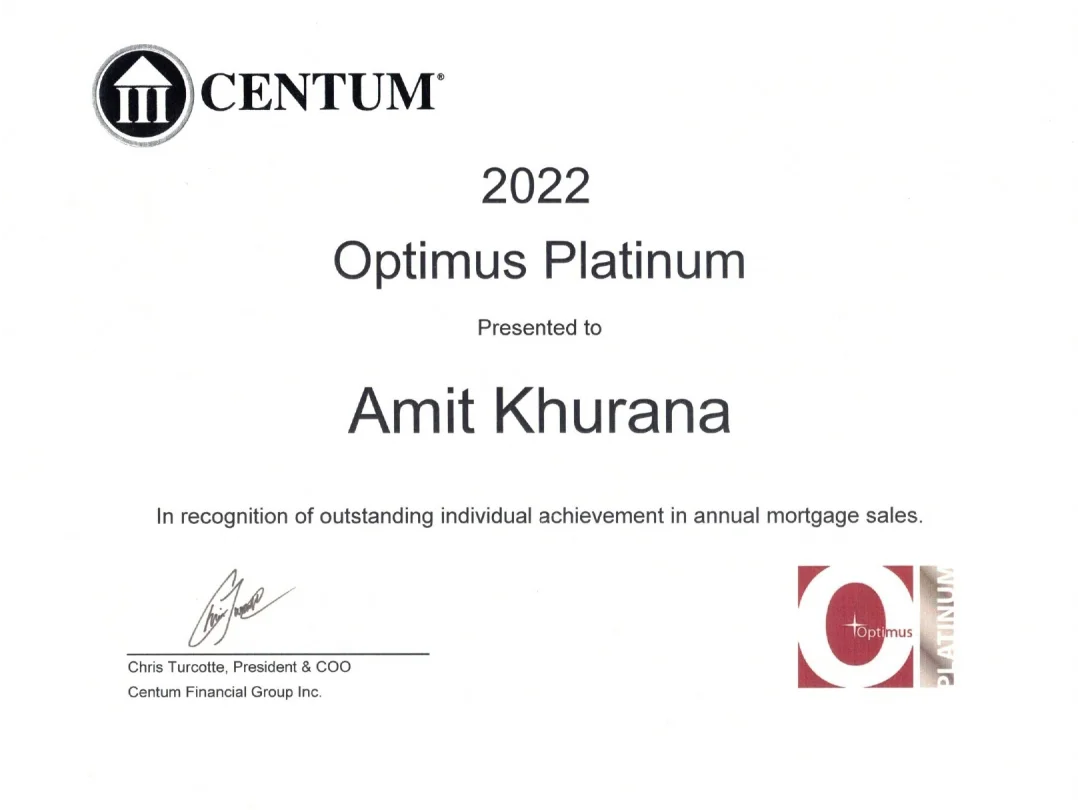

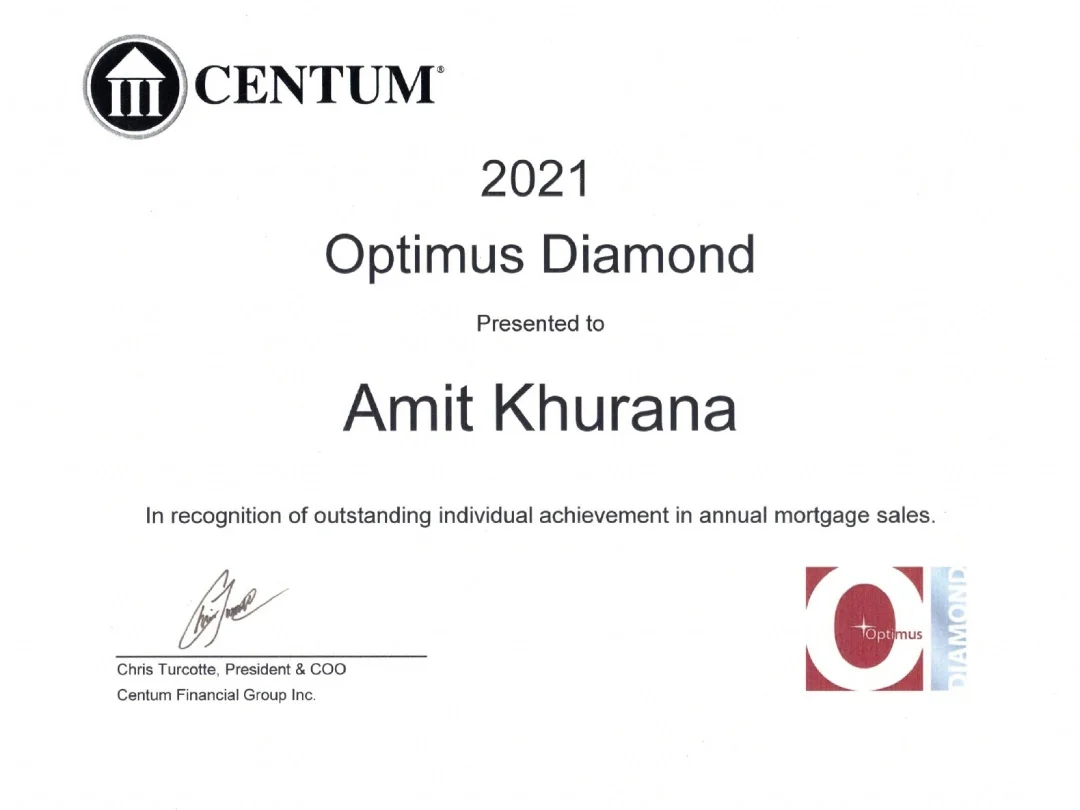

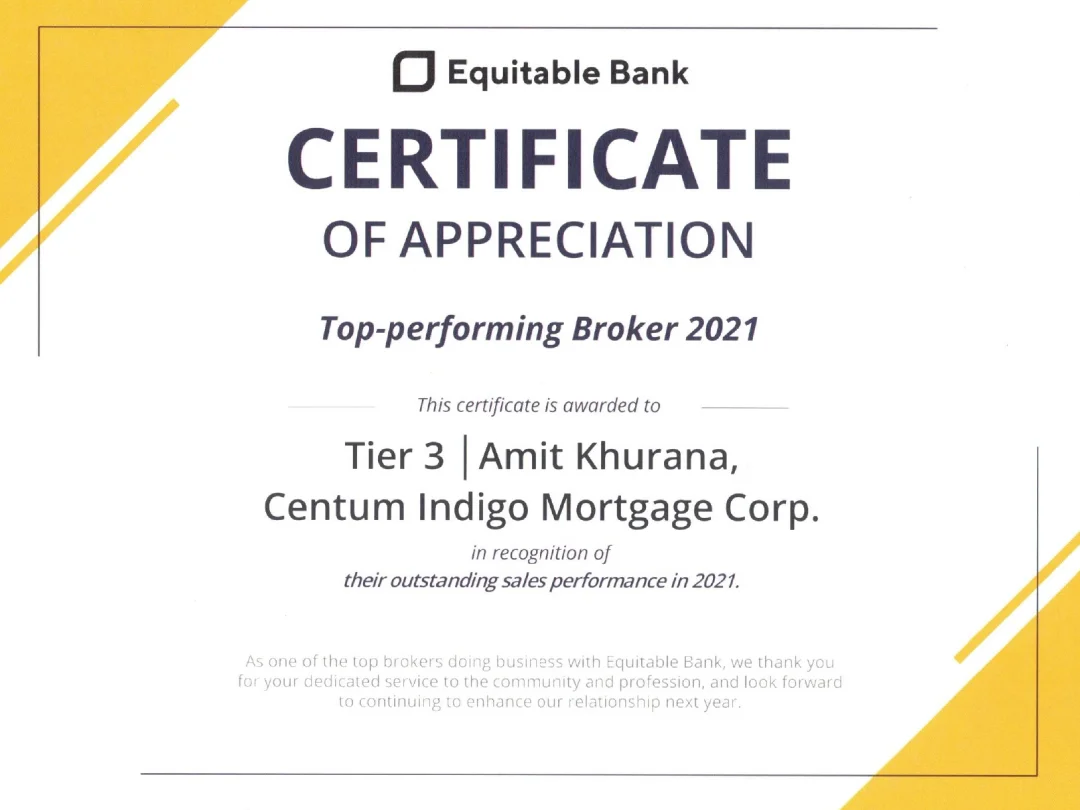

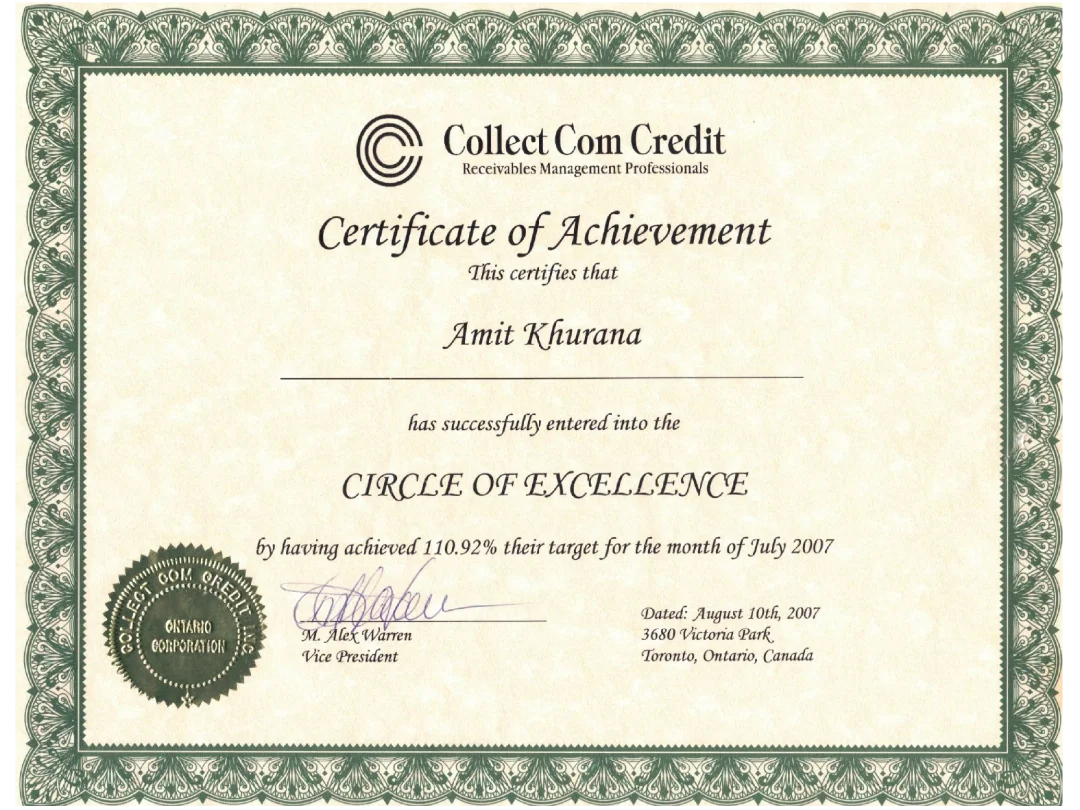

Awards & Accomplishments